Moving from Retrofitting to Made for Purpose Manufacturing Equipment

Cell Gene Therapy Insights 2018; 4(9), 941-946.

10.18609/cgti.2018.089

Q With the recent run of cell and gene therapy approvals and an ever-increasing level of investment into this sector, what do you see as the biggest developments that have enabled this progress to date?

NB: Clearly, the overwhelmingly positive clinical results we have seen for CAR-Ts have quickly pushed these therapies through the clinical stages and into approvals, both here in the USA, and in Europe. Regulatory fast tracks are paired with continued investor confidence, as seen by both successful public offerings and recent acquisitions.

Since these initial therapies are based on blood as a starting material, the industry has been fortunate to have a broad range of blood processing equipment at its disposal, which has been complemented by bioprocessing equipment. In essence, the industry has progressed to this stage by retrofitting existing equipment to its needs.

RG: As Nina says, the recent positive clinical results are the main driver and these in turn are triggering increased investment. I also think that fear of missing out on the next big thing is a strong factor driving the increased levels of investment rather than many recent developments that have enabled the progress.

Q What changes do you think are needed in order for this to grow into a scalable and sustainable industry?

NB: From what I have seen and heard first hand, the industry is now driving towards ultra-short processing times of as little as a day. Clearly, in comparison to the 10-day average that we are using today, that would mean significant cost savings. Both in my previous role at Lonza, as well as now working with FloDesign Sonics, the approach we are taking is to develop ‘made for purpose’ manufacturing equipment that enables the industry to deliver these life saving therapies. It means that we have to work very closely with the process and therapy developers to understand the minute details of their approaches; this is a Quality by Design approach feeding into equipment and single-use disposable development. That said, Richard is the engineering expert here, I will let him speak to that.

RG: The key needs for the industry in terms of improved manufacturing equipment are threefold: GMP-ready equipment (automated both in performance and communication/control), process scalability (to enable both affordable process development and a clear path to commercial manufacturing) and affordability (either in direct cost or cost savings as a result of increased efficiencies).

It is only now that tool providers are starting to design equipment specifically for the GMP environment; previously, this was something that only a few custom design houses considered. Closed, automated, robust and reliable processing is key to commercial manufacturing, and integration into corporate electronic data management systems provides significant additional benefits – whether this is just an electronic batch record, or all the way up to full integration into a manufacturing execution system. Integrated manufacturing systems is a key part of the supply chain which has yet to be addressed in the Cell & Gene Therapy industry.

Scalability and flexibility are crucial for process developers, this creates a unique challenge for tool providers. Solutions must be GMP capable and have designed-in flexibility, considering that some processes are still in development.

Ideally, a simple to use, flexible cell processing system should be delivered to the Process Development team. This system should have an inbuilt ability to lock the equipment into a GMP mode that allows the production operator access only for data entry and the physical interactions required to set up, initiate processing and unload the disposable.

As the industry matures and therapy producers develop a deeper understanding of their cells and the impacts of various unit processes and manufacturing technologies on the cell’s development pathways and ‘happiness’, I believe that we will see a growing desire for gentler processing technologies and, where possible, similar or identical means of manipulating the cells being used in multiple sequential process steps. This in turn will lead to the ability to combine multiple process steps into a single, or perhaps two, disposables that in turn are processed by one or two pieces of equipment in the manufacturing chain. FloDesign Sonics acoustic cell processing technology is one potentially ground-breaking solution which could conceivably bring multiple steps such as cell selection, wash and concentrate, cell culture and potentially even more processes into one disposable piece of equipment. This will deliver multiple benefits to manufacturers: fewer disposable sets needed for each patient (autologous) or per batch (allogeneic), consequentially reducing hand offs/connection steps between unit processes (lower risk of process contamination), reducing manufacturing costs, and also reducing opportunities for operator error.

The recent focus on total treatment cost and supply chain logistics has prompted a burst of activity to both develop better flexible and scalable GMP manufacturing solutions, as well as a number of improved products and services for cold chain and logistical supply and distribution of Cell & Gene Therapy materials and products.

Q What do you see as potential pressure points in the supply chain that will need to be addressed as the industry scales?

NB: There are a number of ways to look at this: the most obvious supply chain is all the materials, from media, supplements, to viral vectors (which have their own complex supply chain). We have heard about the latter in great detail over the last few months, so I won’t go into the specifics here. GMP-grade materials are inherently expensive, and for many of them, the manufacturers don’t have the luxury of a second source. This means that if the supplier cannot meet demand, an entire product may be affected. The same holds for custom antibodies and selection beads, with limited supplier options and resultant high prices.

Another angle is the vein-to-vein supply chain, which includes scheduling at the hospital, transport to the manufacturing site, and then back again. Traceability is a key word here, and there are a couple of suppliers that focus on nothing but tracking and recording – such as Vineti and TrakCel. Particularly for autologous, patient-specific therapies, knowing where a sample is, and what the manufacturing status is, at any given time will be key to commercial success.

The logistics aspect is another one: if you listen to some of the service providers, they will give you 99% reliability on sample delivery. In the first instance, that sounds great. But if you scale that to 1000 patients, it will mean that 10 patients won’t receive their treatment, simply because something has gone wrong with their shipment. In a life-threatening disease situation, this may be a death sentence.

Q Cost of Goods continues to be a concern for cell and gene therapies – what are the key cost drivers and what steps can be taken to optimize them, thus potentially reducing the costs of these therapies?

NB: In an article published earlier in the year by Lopes et al., the authors looked at this critical question of where the key costs sit within the Cell & Gene Therapy manufacturing pathway [1]. In their approach, they benchmarked a fully manual autologous manufacturing process. In that context, labor was the key cost driver, followed by material and capital, i.e., facility cost. If we now consider the more mature processes that are used for the majority of CAR-T products, we can assume semi-automation, which should reduce the impact of labor to some degree, and put more weight on the cost of materials.

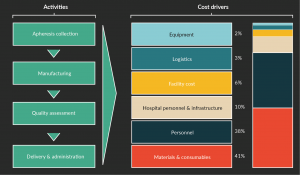

Here at FloDesign, we have put together a top-line model, which incorporates a number of assumptions, and is based on a standard 7-day CAR-T process in a commercial setting, assuming 2800 doses per year. This process assumes a lentiviral transduction, and standard equipment including a fully closed and controlled bioreactor, cell selection equipment, a biosafety cabinet, all performed in a Class B environment. I have gathered anecdotal information from colleagues in the industry, as well as incorporated experiential data from previous assessments. In Figure 1, you can see that in this scenario materials contribute 41% of the cost, followed by personnel at 38%. So, just by using existing equipment, the industry was able to reduce the personnel cost.

As a next step, there are a few levers we should be able to manipulate. Firstly, the previously mentioned process shortening. If we need to use equipment less, for example by selecting for more potent cells, both facility and equipment cost drivers will be even less impactful. More importantly, however, this would also reduce the cost of raw materials. The current process uses large quantities of media and supplements, as well as viral vectors. By optimizing the doses to consist of only a small number of highly potent cells in a small volume without an expansion step, we should be able to significantly reduce the amount of raw materials used. From what I hear, this is not wishful thinking but rather a near-term reality. With that said, now is therefore the time to start implementing Richard’s approach of ‘made for purpose’ equipment that can perform these processes in a fully automated way, and generate these highly potent cells without manual interventions, and ideally performed at the hospital/clinical site.

What impact could this approach have on the costs of these therapies? Let’s do a little maths: the current cost per dose is around $100,000, and the outlined efficiencies should be able to achieve around 60% cost savings. Hospital costs would remain the same, while I would estimate that we can reduce the cost of personnel and materials by around two thirds, as well as some additional savings around equipment, logistics and facility. Personally, I think this will require an entirely new, multidisciplinary team approach where our existing knowledge is laid out in minute detail and we optimize everything. Ambitious? Maybe; but not inconceivable. Let’s get started.

Reference

1. Lopes A, Sinclair A, Frohlich B. Cost Analysis of Cell Therapy Manufacture: Autologous Cell Therapies. BioProcess International, March 2018.

Affiliations

Nina Bauer & Richard Grant

FloDesign Sonics