Automation: systems thinking shows the value of manufacturing technology & those who can integrate product & process development

Cell Gene Therapy Insights 2017; 3(8), 597-602.

10.18609/cgti.2017.052

The use of the word automation immediately raises a question for a manufacturing engineer – what do the machines do and what do the people do? The answer of course is that the machines do what they do best and the people do what they do best. Significantly, however, this is a systems level question. In this editorial, I am going to use some systems thinking to define one or two critical paths forward for our industry where I think there are opportunities to learn from experiences in both mature and developing manufacturing industries.

The sector is at something of a turning point, we are approaching 500 products in Phase II trials with successes emerging and now many businesses are starting to think about manufacturing seriously. Establishing a robust supply chain and controlling cost of goods will be critical to them. Many are turning to try and tame the manufacturing processes used to make complex and living, highly varying, biological products. The products themselves are still in development – mode of action and consequently many critical-to-quality metrics will not be clear until Phase III is over. These product businesses need to look seriously at their manufacturing strategy, manufacturing technology and production systems now because Phase III trials require the products to be built with the real process. Critically, there is a requirement to manage the interactions between product and process development, and there is, comparatively, little discussion of this in our community as yet.

Those of us already in the manufacturing of these therapies are also seeing changes. Platform unit processes are emerging, some of these are ‘second generation’ and better tailored to our products with better integration and coupling of product and in-process testing. Information systems, modularity and process integration issues are becoming clearer. The language of ‘end-to-end’, ‘front-end’, ‘back-end’ and ‘closed’ is regularly used. Key technology suppliers are emerging – both large businesses with a portfolio of products and smaller companies with more novel solutions. Key Contract Manufacturing Organizations/Contract Manufacturing and Research Organizations (CMOs/CMROs) are becoming more apparent and the sector is maturing. The industry is addressing standards for manufacturing, via national standards organizations and ISO committees and debating critical issues including comparability with regulators. Core centres of excellence in bio-processing and bio-manufacturing are working out their place in the international picture. Many of the companies are acquisition targets as the global industry takes shape. Many of the people within these companies are also recruitment targets as there is more recognition as the industry matures of the need to have people who can think at a process and system level and with direct experience of this new generation of products.

Given this context it is time to move to my two core themes: the development of systems architects capable of integrating product and process development; and the business models for manufacturing technology businesses given its value to the field.

For a moment, let’s reflect a little about our production systems and who designs them. In the automotive business this is clear, there is a whole industry of machine makers and systems integrators who supply the Original Equipment Manufacturers (OEMs) and the OEMs are expert customers in a very tough, cost and time sensitive manufacturing ‘get it out of the door’ world. This provides the benchmark for the mechanical manufacturing engineer, as do the approaches used by the chemical engineer in the chemicals and petroleum industry.

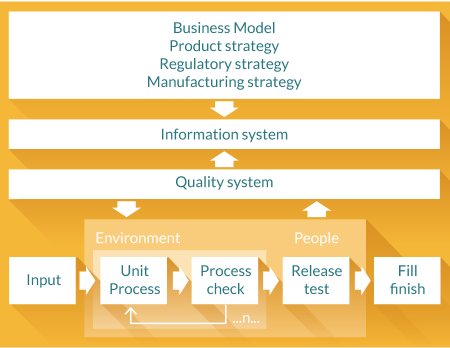

For us in this emerging industry of cellular and gene therapies, these structures are much less clear. For us the production system is the process, the machines, the people, the materials transport system and the information system- just as it is for our colleagues in other industries- but other things are overlaid on this that increase its complexity. The first overlay is that we operate within a controlled physical environment, this is not unusual – most processes for making sophisticated electronics and semiconductors require perhaps more challenging environments to achieve control at parts per million particulate level – but we have the very real challenges of equivalent numbers of living, colony forming particles to manage within aseptic processes. The second, perhaps the most significant overlay of course is that we have to operate within a regulatory compliant pharmaceutical level quality system and this determines much of what we have to do and how we do it, particularly with respect to product quality. Figure 1

Reflecting on this I am reminded of some work carried out in the 1990s in the complex product development in the electronics industry in which a close colleague and I collaborated [1]. This focused on the development and manufacturing of multichip modules, the core of mid-sized computing machines, where there are tight couplings between the two. These are highly complex and precise products with extremely demanding quality requirements made in controlled environments. The product quality challenge arose from the combinatorial explosion of the number of interconnections that had to be made. The critical piece of learning for me was the way that project teams were constructed to recycle learning from product to product and to build architects, effectively programme leaders, capable of resolving the issues consequent on the need to closely integrate a developing product and its production system. The core step made by a number of Japanese businesses was to take team members who had been through much of the new product introduction process, but in particular the later stages of the building and running of the real production process and to recycle them as key members of the team in the earliest stages of the next project. This ensures transfer of learning and the avoidance of costly mistakes. Critically, it builds project team leaders who have deep practical experience of both early stage and late stage issues and who could act to integrate the multiple strands of the programme. As an industry we need to start doing this and work harder to build such architects/integrators and to understand where they sit within the value system. Where are they – are they in big pharma, are they programme managers in SMEs or are they within CMOs?

I will now turn to some of the issues associated with the need to build a robust supply chain. At the ‘top of the heap’, the value pinnacle, we have product companies with the promise of the pot of gold – no journey like this should be started without the promise of a pot of gold – consequent on the development of a successful product addressing real and significant need at a (just) affordable price. These may be within a large pharmaceutical business or be a consequence of a start-up that went the distance and actually launched a product. They may or may not have used a CMO. Processes may have been chosen, hopefully by an informed architect of the kind we have described, and put together within the product businesses or within a CMO or equivalent.

Critically, such high quality products will never be made properly without the right processes and much of the processes will be embodied within a machine or machines. Automation is our language here, but actually what we are talking about is much closer to what is better understood, for those with a mechanical engineering background, by the phrases machine tool and, more generically, manufacturing technology including both hardware, mechanization, and software, programmable, components. Without the right machines the pot of gold the therapy represents in our case will never be captured either by manufacturing reliably at scale in a factory setting or by local delivery in multiple hospital settings.

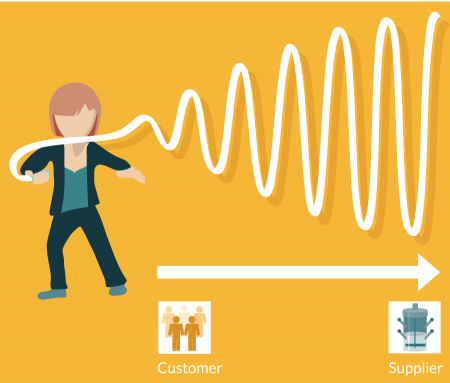

Machine tool making has always been a tough business. It is extremely expert in both engineering and deep craft capability senses and has tended to be carried out in relatively small businesses, i.e., much smaller than the OEMs or CMOs that are suppliers. It is also extremely sensitive to what is known as the ‘bullwhip’ or ‘Forrester’ effect (Figure 3

One of the tactics used by manufacturing technology suppliers to-date to address this has been to use ‘razor/razor blade’ or given their pricing ‘printer/printer cartridge’ business models giving rise to very significant consumable costs. The consequent increase in cost of goods impacts the likelihood of success in the marketplace and consumables complexity is unlikely to ever allow the transition into better processes.

We need to consider how the machine maker is drawn into the value system and how value can be shared across the system – perhaps by co- or collaborative development – I sense that this is becoming more of an issue for the field and something we have to think differently about as an industry. We have to think hard about our business models for manufacturing technology supply and where the value lies in manufacturing technology businesses because we cannot build this industry securely without them. In the USA and the UK in particular, this will require robust intellectual property portfolios addressing key technology gaps and patient capital. We also need to understand the global development of the industry with the increasing presence of Japanese businesses, with their longer time horizon, as CMOs and machine suppliers post the Yamanka and Sulston Nobel prize, and the importance of German businesses and their, again longer time horizon, mittelstand tradition. This highlights the need for regionally oriented growth interventions building on manufacturing capabilities of known excellence.

Manufacturing technology is a key enabler, it is more than a tool and applying it in a value system is more than dipping into a toolbox and grabbing the thing you think might do the job. We need to understand how value is secured within the value system and consequently shared, and how to build the architects that can manage the integration of product and process creation within this highly regulated world to deliver the benefit of this new generation of products to patients.

financial & competing interests disclosure

David is a member of the scientific advisory boards of both The Electrospinning Company, Harwell, UK and FlowDesign Sonics, Wilbraham, MA. No writing assistance was utilized in the production of this manuscript.

References

1. Iansiti M. Technology Integration, making critical choices in a dynamic world, Harvard Business School Press, 1998.

2. Forrester JW. Industrial Dynamics, MIT Press, 1961.

Affiliation

David J Williams

Loughborough University, Loughborough, LE11 3TU UK.

d.j.williams@lboro.ac.uk

This work is licensed under a Creative Commons Attribution- NonCommercial – NoDerivatives 4.0 International License.