Japan’s regulatory gamble and what it means for the Industry

10.18609/cgti.2015.009

The Follower Takes the Lead: How Japan’s trifecta of economic policy, regulatory innovation, and an aging demographic may disrupt a global industry and the very future of medicine.

On November 20th 2014, the Japanese legislature passed the new Act on the Safety of Regenerative Medicine (ASRM) and the revised Pharmaceuticals, Medical Devices, and Other Therapeutic Products Act (PMD Act) [1]. It is hard to make that sentence sound exciting, but what many outsiders have yet to fully appreciate is the tectonic shift in Japanese pharmaceutical regulatory policy this represents. Put another way, these two pieces of legislation lay the foundation for Japan to become a world leader in regenerative medicine and cellular therapy. The most interesting question for many is “why?” Why has a country synonymous with “risk aversion” and “following” taken such a drastic step away from the norm and more importantly, what does this mean for commercial players involved in the regenerative medicine/cellular therapy industries? To answer this, it is important to understand what the Japanese regenerative medicine and cellular therapy regulatory environment looked like prior to these laws and the dynamics that pushed Japan to change the status quo.

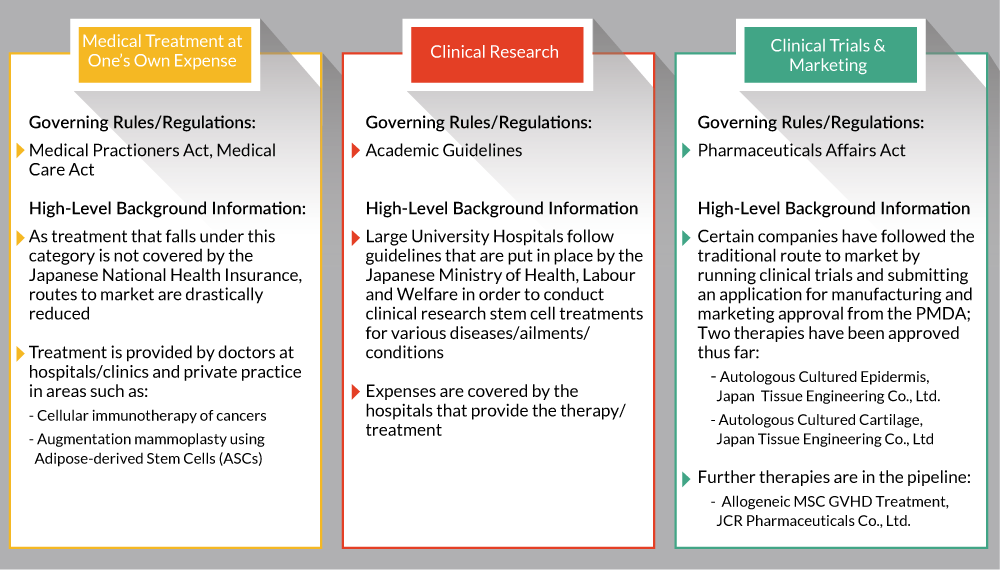

Prior to enacting the ASRM and revised PMD Act, the Japanese regulatory landscape surrounding regenerative medicines and cellular therapies was highly fragmented. Companies had the option to bring their drugs to market via the ‘Clinical Trials & Marketing,’ ‘Clinical Research,’ or the ‘Medical Treatment at One’s own Expense’ methods (Figure 1

Demographics

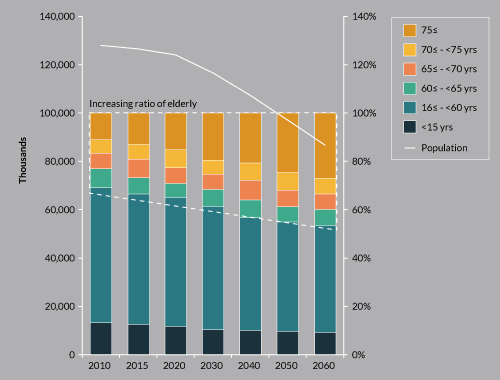

An aging population (Figure 2

iPSCs

In October 2012 Dr Shinya Yamanaka along with British citizen Sir John Bertrand Gurdon were jointly awarded a Nobel Prize for Physiology or Medicine “for the discovery that mature cells can be reprogrammed to become pluripotent”[2]. This cellular reprogramming to create what are commonly known as induced pluripotent stem cells (iPSCs), proved to be a great source of pride for the Japanese and its development was seen as an avenue for Japan to establish itself as a world leader in an emerging technology. For a nation that is 20 years into a “lost decade”[3], this development was seen as an opportunity to re-establish Japan’s importance on the global stage.

Abenomics

Prime Minister Shinzo Abe announced his national economic revival policy in December 2012. The policy consisted of the three arrows: monetary policy, fiscal policy, and economic growth strategies. Two key components of Abe’s third arrow – economic growth strategies – are the “Japan Revitalization Strategy,” and the “Healthcare and Medical Strategy,” which consist of the creation of a domestic environment that accelerates the research, development, and commercialization of regenerative medicine technologies and as a result positions Japan at the forefront of an expanding global market.

A conservative and confusing regulatory framework was perceived to stand in the way of the kind of clinical, financial and economic innovations Japan’s leadership wanted to motivate. Regulatory reform was seen as a prerequisite to programs that presented the opportunity to cut medical expenditures, capitalize on the domestic growth potential of a fledgling global industry, and use Japan’s leadership as a means of competing for the world’s business in this emerging industry. In short, they thought and acted like a business. The first thing they said is: “we need to cut costs and increase revenue.”

But government policy can affect only so much change. In the end, these regulatory changes only create a fertile environment for success. The long-term economic success of this initiative will depend heavily on how the commercial sector views these regulatory changes, and more importantly, how they adapt to them. The good news is, when evaluated in light of a few key questions, we can already identify signs of these reforms having their intended economic impact [4].

Q1. What is needed to build a vibrant regenerative medicine industry in Japan?

“Japan’s Ministry of Economy, Trade and Industry (METI) is one of the government’s organizations committed to establishing Japan as a global leader in the commercialization and industrialization of regenerative medicine. METI is focused on promoting government and private enterprise initiatives that will develop standards and safety measures, support the development of related manufacturing technologies and services, help strengthen ties with foreign companies, promote a better understanding of regenerative medicine, and enable other initiatives around the safe and effective development of these therapies,” stated METI’s Hidetaka Nishimura, Director, Bio-industry division, when asked for a statement for this article.

Japan’s METI coordinates much of its external trade initiatives through the Japan External Trade Organization (JETRO). Because METI recognizes that its potential leadership in global regenerative medicine will rely heavily on foreign industry participation, it is extensively utilizing JETRO to engage companies abroad in discussions about coming to Japan with regenerative medicine technologies. For instance, when the authors interviewed Kazuo Nakamura, Executive Director of the Toronto office of JETRO, for this article, he stated as follows: “Due to recent regulatory changes in the Japanese regenerative medicine sector, there are great opportunities for foreign cell therapy companies to consider doing clinical trials and commercializing products in Japan. I encourage foreign companies to follow the lead of companies such as Canada’s RepliCel in entering the Japanese market and JETRO looks forward to supporting companies in establishing their business in Japan.”

If Japan is keen to establish themselves as a world leader in regenerative medicine and cellular therapy they will need a good cocktail of domestic innovation, foreign interest, capital investment, manufacturing, and industry cohesion:

Domestic innovation

Japan has long had an extremely active R&D base. This country is the birthplace of countless inventions and technologies that we see and use in our everyday lives. In fact, almost any global index will show that the Japanese are amongst the highest in the global patent granted listings. This is equally true in the pharmaceutical industry.

One, if not the major, reason why Japanese pharmaceutical innovation is not as well known globally as it ought to be, is the comparatively small number of announcements that are made in English. But if you accept that Japan has a large number of R&D firms that develop drugs solely for the Japanese market, the situation is easier to grasp.

ID Pharma is a great example of a Japanese company that has received little English language attention [5]. The company has its roots in a 1995 national research project for the development of gene therapies. Since its founding, ID Pharma has developed and patented a unique RNA-based viral vector technology. In fact, their lead product, DVC1-0101 [6], is currently being developed to treat intermittent claudication (IC) and critical limb ischemia (CLI). They also have other candidates in the pipeline including an AIDS vaccine that is being co-developed with the International AIDS Vaccine Initiative [7].

In addition to the smaller companies like ID Pharma, there are also the large corporate players. Because of the previously discussed policy initiatives, increasingly those larger corporate players are focusing their attention on the emerging opportunity of regenerative medicine. Take for instance, Takeda Pharmaceuticals’ announcement that they will be teaming up with Dr Yamanaka’s Kyoto University to the tune of ¥20 billion over 10 years for a project that focuses on regenerative medicine and drug discovery using iPSCs [8].

Foreign interest

The regulatory shift has already propelled foreign firms operating in the regenerative medicine and cellular therapy area to re-prioritize where Japan fits in their corporate strategy. Obviously, the key will be to maintain this positive momentum and spur continued growth; growth that can be achieved by companies such as those listed here:

RepliCel (Canada)

Entered into an exclusive geographic license and commercialization agreement with Shiseido for their hair regeneration technology, RCH-01 for much of Asia [9]. Shiseido will manufacture the product in their own facility in Kobe, Japan and is expected to launch a clinical trial in 2015 which could be sufficient to predicate Japanese conditional approval to market the product as soon as 2018.

Regeneus (Australia)

In 2014, Regeneus announced their intention to seek a Japan partner for their allogeneic adipose-derived mesenchymal stem cell (MSC) product, Progenza, targeting osteoarthritis and other inflammatory musculoskeletal conditions [10].

Athersys (USA)

In early 2015, Athersys announced a partnership and license agreement with Chugai Pharmaceutical, a Roche Group Subsidiary, to develop and commercialize their MultiStem® cell therapy for ischaemic stroke [11].

Mesoblast (Australia)

In October 2013, Mesoblast acquired Osiris Therapeutics’ culture-expanded stem cell therapeutic business thus inheriting Osiris’ existing partnership with JCR Pharmaceuticals. The collaboration is centered on Prochymal® (JCR development code – JR-031), an allogeneic MSC product for graft-vs-host disease (GVHD).

Pluristem (Israel)

Pluristem has made numerous announcements relating to their PLX-PAD cells and intentions to commence Phase I/II trials in Japan for the treatment of CLI with the most recent announcement being made on May 13, 2015 and August 12, 2015 [12].

Cytori (USA)

Cytori announced on December 4, 2014 that their Celution® System and autologous adipose-derived regenerative cells (ADRCs) would most likely be classified under current Class I device regulations and the lowest risk category of the newly enacted ASRM [13].

Capital investment

A persistent problem for Japanese pharmaceutical start ups, and this holds especially true for those with emerging technologies, is the difficulties around raising capital. While traditional avenues such as the Innovation Network Corporation of Japan (INCJ) exist, the competition is intense. The good news is that when the ASRM and the revised PMD Act became law, it galvanized the focus of large domestic groups such as Mitsui and Shinsei as well as foreign investment groups such as Fidelity Group on the emergence of regenerative medicine as a national priority – and this is expected in turn to lead to the larger Japanese corporates taking a more active role in this area.

Manufacturing capability

Another important component to a vibrant industry is the existence of critical service infrastructure such as testing, manufacturing and clinical oversight. Recent months have given rise to a new group of potential Japanese contract manufacturing organization (CMO) solutions that stand alongside the more frequently mentioned options of MEDINET and Takara Bio (MEDINET, for instance, intends to focus on contract manufacturing for both domestic and foreign entities under both the PMD Act as well as hospitals/clinics under the ASRM). These include less well-known but equally viable entrants such as:

Nikon

Announced an exclusive collaboration with Lonza in the field of cell and gene therapy manufacturing in Japan on May 7, 2015 [14].

PharmaBio

Announced on April 28, 2015 that they had entered into a memorandum of understanding (MOU) to establish an alliance with the Australian-based Cell Therapies Pty Ltd to provide cell processing and delivery solutions in the Asia Pacific region [15].

FBRI’s Division of Cell Therapy

This long-standing organization has operated several good manufacturing practice (GMP)-level cell-processing centers since 2002, including one for an investigator-led trial for cultured autologous cartilage cells [16].

Rohto

Rohto acquired the Rohto Research Village Kyoto from Bayer Yakuhin in 2005. They have a stated interest in adipose-derived MSCs. While they are still a few steps behind the competition, their size and established presence in the OTC market means they could be a force to be reckoned with [17].

Industry cohesion

On March 12, 2015, the Alliance for Regenerative Medicine (ARM) entered into an MOU with Japan’s Forum for Innovative Regenerative Medicine (FIRM) [18]. FIRM, an industry association made up of over 160 member organizations, aims to establish stable access to the benefits of regenerative medicine in Japan. This alliance between ARM and FIRM means that Japan will not only have a domestic forum dedicated to industry cohesion, but the cohesion will be extended to the USA, Europe and other foreign jurisdictions.

Japan maintains a robust foundation for domestic innovation and has been attracting more foreign interest with the passing of the ASRM and the PMD Act, and FIRM’s efforts to establish industry cohesion – both of which have set Japan in a very positive, innovative, and inviting direction. In the fledgling global regenerative medicine and cellular therapy CMO market, Japan has a steadily increasing list of potential entities from which to select. Capital investment is still relatively weak, but this is mainly a problem for smaller ‘Japanese’ firms looking for capital. Foreign firms will often times have a more robust home-market from which they can source capital should the need arise. Foreign firms looking for Japanese capital will learn to appreciate that domestic investments tend to be much more strategic than is the case in the West – particularly compared to the USA where return on investment and exits tend to overwhelmingly govern.

Q2. What are the unique advantages for foreign cell therapy companies in Japan?

The Japanese regenerative medicine and cellular therapy market offers many advantages that favor foreign companies including: strong science and technical expertise, unparalleled experience in engineering and manufacturing, and now the opportunity to potentially bring a cell therapy product to market quicker in Japan than may be possible in any other regulated market in the world. Ironically one of the other strongest advantages that foreign companies may enjoy in Japan is the English language bias. The bulk of R&D-related information within Japanese companies is still in Japanese. This makes global commercialization of domestic innovation challenging. It is important to note that for this field to be a success for Japan, they will need to export this IP through English-language channels. It is a lot more difficult to export Japanese data globally than it is to import English data domestically. For that reason, Japanese pharmaceutical firms and domestic investors may not be interested in partnering with the smaller domestic R&D companies with the same zeal as partnering with foreign companies looking to enter the Japanese market.

This potentially leaves a lot of smaller Japanese firms considerably undervalued when compared to their foreign English-based counterparts. Ironically foreign companies may find opportunity among these companies to establish a national footprint and Japanese team for a fraction of the acquisition cost/investment they might otherwise invest to do so or would pay in their home market. Furthermore, given the challenges around raising capital domestically, it is easy to see how a capital investment from, or acquisition by a foreign firm could be a solid win–win.

Q3. What pathways exist for foreign companies to commercialize in Japan?

Foreign regenerative medicine/cellular therapy companies can commercialize their products in Japan in many ways. Some examples are provided below:

Strategic partner method

For a long time, foreign companies have had a difficult time cracking the Japanese pharmaceutical market. Forming a strategic partnership with a local company can help a foreign company navigate their clinical trials and the approval process. Athersys’ partnership with Chugai, and RepliCel’s partnership with Shiseido are examples of this model.

Financial partner method

This method is rare in Japan, but “rare” does not mean “zero”; for the companies that are able to pursue this method, it may provide them with a stronger negotiating position once the clinical development of their product evolves. This model involves finding an institutional or strategic investor (or syndicate of such investors) that invests in securing a license to a product from a foreign company and to funding its development/commercialization in Japan. The license would then be driven through Newco joint-venture, Newco licensing partner, or even an existing company that becomes the strategic partner by virtue of a three-way deal. While this kind of strategic investment is rare in North America, it would appear to be the preferred method of investing among the emerging class of investors in Japan who are actively seeking regenerative medicine opportunities. However, there are no known examples yet of such a transaction being completed with a foreign company.

Independently pursue clinical stage

For the companies that can, there is the option to enter clinical trial development independently without a domestic partner. These firms will need to choose their CRO/SMO support carefully to ensure they have the requisite experience and understanding of a rapidly changing market. While Pluristem and Cytori are two foreign companies seemingly taking this route we believe this to be a difficult path for most foreign companies.

CMO partner method

A less common method for product commercialization in the Japanese market is to partner with a local CMO. Japanese CMOs are currently establishing a domestic manufacturing base that the Japanese regulatory authorities will look to for quality manufacturing. However, in the early stages these CMOs will need documented experience in cell manufacturing which MEDINET is one of the few that is currently in a position to provide. There are some early signs that some Japanese CMO’s may be prepared to provide services in exchange for equity similar to what some CROs are now doing in the USA and elsewhere.

Q4. What will be needed to obtain conditional approval to market a cellular therapy in Japan?

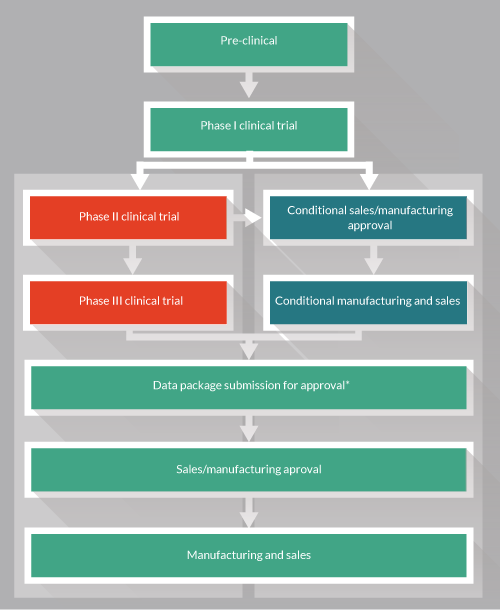

Unfortunately the PMDA is still short of being crystal-clear on explaining the new “conditional/term-limited authorization.” In fact their explanation had many thinking that there was a new approval-pathway that differed from the regular one. Companies interested in bringing their product to Japan wanted to know how they could get their product “on the conditional approval pathway.” A more accurate explanation of how the scheme works is shown in Figure 3

There isn’t a separate path or application process in place for conditional approval. Indeed, it would appear conditional approval will be granted by the PMDA in the process of considering a clinical trial application. The determination of whether a product qualifies for conditional approval rather than a next-phase clinical trial will be made on a case-by-case basis depending on the clinical trial application, and in relation to the data collected at that point.

It is however important to point out that a company’s understanding of what is needed for ‘conditional approval’ can be more realistically ascertained after holding consultations with the PMDA.

Q5. Who is currently expected to set the precedent of the first conditional approval?

Mesoblast’s Japanese partner, JCR Pharmaceuticals, announced on October 1, 2014 that they had filed for marketing approval of JR-031. The drug will be used to treat acute GVHD in children and adults. The product registration filing by JCR is subject to a priority review as JR-031 has been granted orphan drug status. If successful, JR-031 will be the first allogeneic cell-based product approved in Japan.

Early speculation was that due to their safety profile, conditional approval might be limited to autologous cell therapies; however according to the PMDA this is not the case and given the significant body of safety data for Prochymal® (JR-031) it would appear the first conditional approval may be, ironically, for an allogeneic product [19].

It will be interesting to see whether this approval turns out to be ‘conditional’ or final as the product has already been the subject of marketing approvals in Canada and New Zealand, though at least the former appears to be tied to post-marketing data submission obligations. Furthermore, because it was a formal marketing approval application one could reasonably argue it doesn’t qualify as the first ‘conditional approval’ under the new regulations and process.

Another company to keep an eye on vis-à-vis conditional approval is TERUMO Corporation, who announced on October 31 2014 that they too had filed for marketing approval of their myocardial regenerative therapy TCD-51073 (meant for the treatment of severe chronic heart failure due to ischemic heart disease) after concluding a multicenter Phase II clinical trial in Japan [20].

Q6. How will reimbursement work regarding conditional approval?

The understanding is that all therapies eligible for reimbursement coverage by the Japanese universal healthcare system will not be precluded by virtue of their conditional approval status. Since the conditional approval system is not an entirely new pathway to approval but rather an appendage to the existing one, this is the only logical conclusion.

However, in Japan a new drug does not receive an official “standard price” immediately after receiving marketing approval (conditional or otherwise). The newly approved pharmaceutical will have its standardized price set at a later date, and that price will be determined by one of these two methods:

Comparable Drug Method: This method is favored when there are drugs already on the market that have similar effects and modes of action. Certain modifications are applied depending on the level of innovation, efficaciousness, and expected market size of the product.

Cost to Produce Method: This method is used when there are no comparable drugs on the market and involves adding a margin on top of the total cost to bring the drug to a patient.

As there are very few regenerative medicines and cellular therapies in the Japanese market today, many believe that the ‘Cost to Produce Method’ will be the one favored by the regulatory authorities. However, it may be argued that J-TEC’s autologous cultured cartilage product JACC, which is priced at over ¥2 million (USD $16,300), is a viable comparator drug due to the fact that JACC is one of the only regenerative medicines/cellular therapies to be approved in Japan. If so, the Comparable Drug Method may be applied. The negotiations for this will undoubtedly be difficult and early cases will likely set the precedent.

Q7. How will the PDMA determine eligibility for conditional approval?

A common misunderstanding among companies looking to market their regenerative medicine/cellular therapy product in Japan under the new regulatory framework is if and how the ASRM “risk categories” influence conditional approval. It is important to remember that conditional approval is governed by the PMD Act and not the ASRM. The products tested and released on the market under the ASRM will not be subject to the same regulatory scrutiny applied to the products released under the PMD Act, but it also means that the ASRM-approved products will not be able to take advantage of the PMD Act’s conditional approval scheme.

Having said that, it is only logical that the PMDA’s scrutiny of whether a product should be eligible for conditional approval under the PMD Act will be based on some type of ‘risk-based analysis’ albeit not tied in any formal way to the risk-categories delineated under the ASRM. It is difficult to tell what type of analysis will be used at the moment, but based on the language used in the Act, it’s likely that the safety of the proposed pharmaceutical/therapy will be a crucial factor and the data supporting the product’s potential efficacy an influencing but “relatively” less scrutinized data set.

Q8. Will other nations follow suit?

There is clear and mounting pressure in almost every regulated jurisdiction for regulatory authorities to provide increasingly expedited, less risk-averse pathways for certain types of therapeutics. This is particularly true where there is a high safety profile and/or there is a critical unmet medical need. It is safe to assume that other nations will follow suit with their own flavor of expedited/conditional or other types of ‘approvals’ that all essentially provide the same end result: early market access. Some will be formal ‘pathways’ such as that which already exists in Europe (Adaptive Pathways project) and the USA (Breakthrough Therapies Designation). Others will be informal, non-codified, practical approaches to early market access such as what has existed for some time in South Korea or may be emerging in Canada.

Understandably, the companies sponsoring the development of products, which might enjoy early market access, are keen to see this trend spread. What is more fascinating is that despite the pharmaceutical industry being widely maligned in the media and by populist politicians, there is an odd convergence of interests emerging with a rapidly growing and increasingly powerful patient lobby behind efforts to provide patients with pre-market access to unapproved drugs. For example, a Right-To-Try lobby is sweeping the USA at the state level where over 20 states have introduced some type of so-called ‘Right to Try’ bills to enable terminally (or even chronically ill patients in some instance) to access experimental treatments still in clinical testing, and before they have been granted market approval.

Q9. Will placebo-controlled trials be necessary for Japanese marketing approval?

The answer to this question gets very interesting because it would appear the Japanese will most certainly be looking for placebo-controlled data produced in trials outside of Japan as a prerequisite for final marketing approval but they will not be a prerequisite for conditional approval, and they will be impossible to conduct in Japan for products which have been granted conditional approval. No patient will subject themselves to the possibility of a placebo product when the treatment product is available and likely even covered by medical insurance.

If it is true that Japan will require any data from placebo-controlled trials to be submitted for their review in a final marketing approval assessment, then what the Japanese are doing would not be possible if every jurisdiction adopted this same regulatory policy. They can only do it because others are not. This presents a fascinating policy and ethical case study that is interesting to consider but outside the scope of this article.

Q10. Are Japan’s actions worth the risk?

The short answer to this question is ‘who knows’? In time we may have the hindsight to judge the prudence of this move but often bold moves cannot be judged by their direct outcome alone (if at all) but by all the ancillary side effects and ripples they cause.

What is clear is that Japan has caught the world’s attention with its bold initiatives and has forced an entire emerging industry to reprioritize where Japan fits in their corporate, commercial, and development strategies. It is also abundantly clear that it has put wind in the sails of those lobbying for change by other regulatory agencies.

It would appear safe to bet that Japan will build an industry with its accompanying employment and tax base at a scale that would otherwise not have existed. In this respect it will almost certainly be a fiscal success in terms of generating top line revenues. The bigger question is whether or not the healthcare system ends up realizing significant cost savings or simply adds to its already unmanageable burden with reimbursed products that add more cost than they subtract.

We are convinced this initiative is not likely to present much increased risk to patients versus the more traditional regulatory approaches. While conditional approval will undoubtedly only be granted where there is a high safety profile, sometimes risks only emerge when more and a greater diversity of patients are treated. Assuming ongoing patient follow-up and reporting obligations are in place to require the reporting of adverse events, there may be an even higher chance of early risk detection from marketed products given the likely diversity of treated patients over the more tightly controlled clinical trial patient cohorts we traditionally depend on to flush out risks pre-approval.

What’s not as clear is whether this bold initiative will save the Japanese government any money. It is possible to imagine that the Japanese healthcare system may pay for a lot of products that really don’t work as anticipated and they are left still paying for the underlying condition they were originally looking to avoid bearing the financial burden.

There are a few cell therapies in Japan which were approved for commercial distribution under the old regulations. For a number of historical reasons, there are few industry-sponsored cell therapies currently in clinical development in Japan. What this means is that for the Japanese regulatory changes to have a meaningful impact on the Japanese population, industry, and economy in the near-term (which was the Prime Minister’s motivation for mandating the changes) there will have to be a dramatic number of products currently being developed outside of Japan brought into the country and granted conditional approval. Which products and companies will be in this first wave is anyone’s guess. We do know however that several companies – Mesoblast, Athersys, Pluristem, Histogen, Regenus, RepliCel and others – have announced concrete activities in Japan.

In terms of the potential impact of this regulatory change on clinical development and commercialization, here’s an illustrative example. If RepliCel Life Sciences would have launched in Japan the same Phase I/II clinical trial for chronic Achilles tendinosis that was launched in Canada earlier this year, they would in all likelihood have required only 12–15 months to produce the kind of safety and clinical evidence sufficient to predicate conditional approval to market the product in Japan. That is several years ahead of when they might be given approval to market that product anywhere else in the world. That is a disruptive approach to therapeutic regulation which will mean a lot to patients suffering from this condition, and mean a lot to companies like RepliCel to have both regulatory endorsement, and the ability to generate revenue to offset further clinical trials elsewhere. It is also expected to have a meaningful impact on the Japanese economy as more cell therapy companies make commercializing in Japan a much higher priority than it ever was.

In the end, this was a policy decision driven by the vision of government leaders at the very top and not by lobbyists, populist reaction, or bureaucrats. From their perspective they took a nation known for regulatory intransigence which had marginalized their global importance in the biopharmaceutical industry and in one policy sweep potentially took a very big swipe at their growing healthcare cost problem, their declining tax base, and the lack of foreign company participation in their biopharmaceutical industry in a way that presented little risk and a whole lot of therapeutic upside to their aging population.

Q11. Is this kind of regulatory innovation likely to happen in the Western world anytime soon?

We will use the USA as an example. In our opinion, the two things holding back the USA from the same kind of regulatory innovation are the litigious nature of American society and the political paralysis currently strangling any type of bold leadership initiatives. Both systems punish risk taking and reward conservative intransigence.

It is interesting to note that the Japanese PMDA was typically perceived to be one of the most conservative regulatory agencies in the world until Prime Minister Abe mandated the agency to rethink the regulation of cell therapies in a way that emphasized safety and reduced the regulatory agency’s emphasis on policing efficacy. The vision was for the PMDA to be empowered and motivated, in its discretion, to provide expedited market access for products shown to be safe and with some level of ‘predictive efficacy’ where the agency deems conditional approval to be warranted based on the agency’s contextually-laden, risk-based analysis. It took considerable political vision and boldness to make this happen. To put it succinctly, Japan’s leadership believes in regenerative medicine and is willing to take the steps necessary to place themselves at the forefront of this emerging industry.

There is no reason why such changes couldn’t happen in other markets but one has to take into account that this requires political leadership with strong vision and boldness, as well as a political system that will allow for such change. Some might argue most Western nations, and notably the USA, currently lack one or both of these prerequisites.

Q12. What advice is there for smaller cell therapy companies outside of Japan to take advantage of the opportunity Japan is inviting them to

participate in?

- Develop a clear strategy for what you are looking to do and achieve in Japan;

- At least determine what is off the table;

- You will need to frequently spend time in Japan to communicate commitment to doing business there. Personal interaction is a must;

- Identify a national representative as your point-of-contact;

- Have a Japanese speaker on your team;

- Participate in biopartnering conferences in Japan;

- Prepare in advance for intense scientific and technical due diligence with as much as possible in writing;

- Set up a direct dialogue with the PMDA;

- Leverage your embassy in Japan;

- Leverage Japan Bioindustry Association, Foundation for Innovative Regenerative Medicine (FIRM), Japanese Regenerative Medicine Society, Asian Society for Cellular Therapy, etc.

- Seek out Japanese nationals at conferences in North America;

- Consider establishing a Japanese manufacturing footprint to serve both the Japanese and broader Asian market;

- Strongly consider Japanese partners for a pan-Asian license rather than simply a Japan-focused license;

- Have an early understanding of where risks might present themselves within your product/therapy and share these with potential partners as soon as is strategically feasible.

This work is licensed under a Creative Commons Attribution- NonCommercial – NoDerivatives 4.0 International License

Affiliations

Lee Buckler*

*Author for Correspondence

Vice President Business and Corporate Development at RepliCel Life Sciences Inc.

Director at Hemostemix

Advisor at RoosterBio

Advisor at BioCision

Colin Lee Novick

Managing Director at CJ PARTNERS Inc.; Director at Ad-comm Group Co., Ltd.; President of the recently founded Type 1 Diabetes Patient Association at Juntendo Hospital in Tokyo.

Financial & Competing Interests Disclosure

Lee Buckler is an employee and shareholder of RepliCel Life Sciences Inc.

CJ PARTNERS Inc. has financial relationships with RepliCel Life Sciences Inc. and Regeneus Ltd.

ID Pharma’s parent company, I’rom Group Co. Ltd., owns 22.22% of CJ PARTNERS Inc.

No writing assistance was utilised in the production of this manuscript.

References & Author Notes

1. Prior to the revision, the PMD Act was known as the Pharmaceutical Affairs Act (PAA) or the Pharmaceutical Affairs Law (PAL). Legislation was passed on the 20th November 2014, brought into force on the 25th November and published on the 27th November.

2. Quoted from the NobelPrize.org website

3. The “lost decade” refers to the time after the Japanese asset price bubble’s collapse within the Japanese economy – originally the year 1991 to 2000

PDF

4. This article focuses predominantly on the ramifications of the PMD Act, as it is this Act that provides industry players with the most attractive avenue into the Japanese market, and subsequently to markets outside of Japan. The ASRM is an Act that is geared towards Medical Institutions (hospitals, clinics, etc.) and CPCs/CPFs providing services to such Medical Institutions; it is interesting legislation in itself, but not a center-piece of what this article endeavors to explain.

5. ID Pharma was renamed from DNAVEC on March 31, 2015

6. Yonemitsu Y, Matsumoto T, Itoh I et al. Mol Ther. 2013; 21(3): 707–4.

CrossRef

7. www.iavi.org/press-releases/2007/220-japan-s-dnavec-and-iavi-partner-on-novel-aids-vaccine-strategy

8. www.takeda.co.jp/news/2015/20150417_6963.html

9. www.shiseidogroup.com/ir/pdf/ir20130530_701.pdf

10. regeneus.com.au/sites/default/files/261114_RGS_New_Japanese_Laws_Take_Effect.pdf

11. www.chugai-pharm.co.jp/english/news/detail/20150302083000.html

12. www.pluristem.com/index.php/press-room/111-press-releases/press-room-2015/521

and www.pluristem.com/index.php/press-room/111-press-releases/press-room-2015/534

13. http://ir.cytori.com/investor-relations/News/news-details/2014/Cytori-Expects-New-Japan-Laws-to-Boost-Adoption-of-Cytori-Cell-Therapy/default.aspx

14. www.nikon.com/news/2015/0507_01.htm

15. www.pharmabio.co.jp/news/detail.php?recid=82

16. www.ibri-kobe.org/english/cell/cell_processing_facilities.html

17. www.rohto.co.jp/global/business/

18. http://alliancerm.org/page/arm-firm

19. While JCR Pharmaceuticals had not received approval when this piece was originally prepared, the company made a September 3 2015 press release announcing that they had received a recommendation for regular approval of their JCR-031 product.

Press Release

20. While Terumo had not received conditional approval when this piece was originally prepared, the company made a September 2 2015 press release announcing that they had become the first company to obtain conditional approval for their autologous skeletal myoblast sheets.

Press Release